It includes everything in Simple Start, plus bill management tools and a time what is a contactless credit card and how to get one tracking ability for adding up billable hours. The desktop version is installed on a computer, while the online version is accessed through a web browser. QuickBooks Online includes all the components of the desktop version, plus additional features such as more app integrations, a fully functional mobile app and more attractive pricing. The Online plans start at $35 per month while the only current Desktop version, Enterprise, must be paid annually and start at $1,922 per year.

What are the key differences between QuickBooks and Xero?

QuickBooks Online, on the other hand, makes it simple to get to this type of View. In a nutshell, the Direct Technique involves subtracting the money spent from the money received. The Indirect Technique, on the other hand, calculates your operating cash flow using your Net Income and Depreciation. The method you choose will be determined by the nature of your Business; nevertheless, it’s crucial to note that Xero only supports the Direct way. Reporting is one of the most significant Accounting Software elements for guiding Financial Strategy and Progress for your firm. As a result, when comparing Xero vs QuickBooks Online, be sure the solution you choose provides the Reporting features you require.

The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication. Merchant Maverick’s ratings are not influenced by affiliate partnerships. QuickBooks Online does offer phone support for its customers but doesn’t have email support. Phone wait times are often short, but the helpfulness and knowledge of representatives vary, so resolving your issue may take some time. QuickBooks Online has a number of other support resources, including a help center, in-software help, training, and guides, to help you get the answers you need. QuickBooks Online also has advanced accounting features you won’t find with some of its competitors.

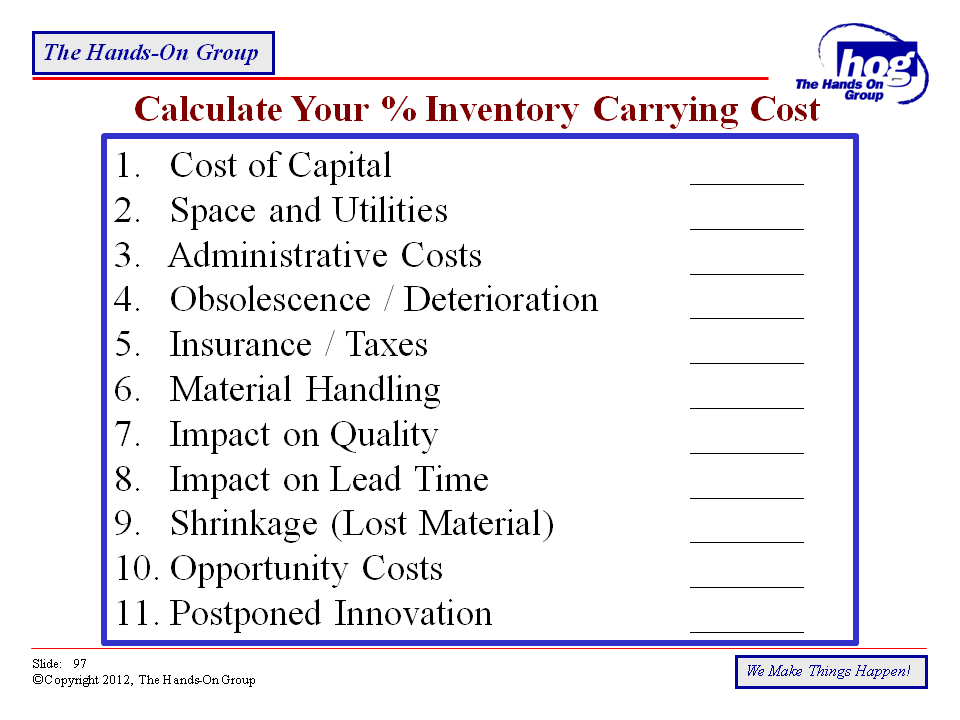

Inventory Tracking

If you just want to get started and add things as you go, Xero may not be for you. As of 2017, you what is the difference between bookkeeping and accounting can also produce GAAP-compliant Statement of Cash Flows for your client reporting needs using Xero’s single integrated reporting solution. QuickBooks has been GAAP and IAS compliant for longer than Xero, and has been the preferred choice of many accountants for some time. All in all, it’s unlikely that your accountant will have any issues with working with QuickBooks.

Who Uses This Software?

For those moving their small business’ accounting over from another application, you can import data into QuickBooks Online using the Import Data function. Help is accessible from any data-entry screen, and a demo company is available for those who want to enter practice transactions without worrying about messing up their own data. Xero’s main entry screen uses a menu bar at the top of the screen for access to system functions. This pared-down menu makes it easy for new users to find their way around the application without too much trouble. You’ll rarely be asking yourself how to use QuickBooks Online as they offer plenty of guidance throughout the application; users can click on the question mark anytime they need assistance.

Essentials supports just three users, while Growing is unlimited, making it better value for large or growing operations. Xero’s financial reporting features start with its interactive reports and budgets, updated in real time throughout the week. You can set specific KPIs, and can jump to detailed transactions when you need more info. Reports can be customized with different columns, formulas, text blocks, or drag-and-drop accounts. More specific categories – Business, Accounting, Payroll, Projects, and more – have their own dashboards, accessible with a horizontal sidebar. You can click any data to see a full, detailed breakdown, complete with historical context, and you can set up data tracking to automatically generate specific reports.

Includes tools that help automate the reconciliation process, along with a global search function and customizable dashboard; has a simple layout. Easy to share information with your accountant and to find QuickBooks experts and online resources if needed. Xero utilizes an App Marketplace with over 1,000 apps to extend its core functionality. Create professional custom invoices with your logo that you can send from any device. Sage may be the most suitable choice for companies with complex accounting requirements, such as multinational operations or specific regulatory compliance needs. QuickBooks works on Windows PCs, Macs, and major browsers including Mozilla Firefox, Google Chrome, and Microsoft Edge.

- If you turn off match notifications, both Xero and QuickBooks Online give you the option of adding a New Transaction or Searching for Another Match.

- When it comes to integrations, QuickBooks Online and Xero are neck-and-neck, with each boasting more integrations than most accounting software options.

- Seamlessly connect QuickBooks to your favorite apps and tools, creating a unified hub for your business operations.

- Having said that, you’ll need to know more about each software’s capabilities in order to determine which option is best for your company.

- Depending on several factors, including the size of your business and the type of business you run, either QuickBooks or Xero will be your best choice.

In this article, we’ll mostly refer to QuickBooks Online, which is what we think you’ll likely opt for instead of Intuit’s desktop version of QuickBooks. On the other hand, Xero may be the better choice for your business. Xero is strong accounting software that has everything you need to track the financials of your business.

Unlike Xero and QuickBooks, businesses can how job costing works in cost accounting get started on Wave for completely free and the software is also available to an unlimited number of users — extending its use even further. Unlike QuickBooks, Xero users do not have any phone support options. To get it, you’ll just need to log in, visit Xero Central, and submit a query. You can then track its progress through a section called “My cases,” which details which specialist is working on it, the current status, and expected response time. With QuickBooks, you can even take photos of your physical receipts, which the software automatically matches to existing expenses.

Xero is an easy-to-use Accounting solution for growing businesses. Businesses can now manage Invoices, Payroll, Bank Reconciliation, Purchasing, Expenses, Bookkeeping, and more, all in one application, thanks to Xero. Xero is a popular choice for over 2 million users owing to its compatibility with over 800 add-on apps and features such as sophisticated, easy-to-use Accounting tools and unrestricted user access. Add-ons include QuickBooks Payroll, which starts at $50/month plus $6/month per employee. QuickBooks Payments allow you to accept ACH, credit card, debit card, and other payments at rates of 1% to 3.5% per transaction. Live bookkeeping services for additional help with your books start at $50/month.