Determining these costs is done according to your own overhead structure and price for raw materials and labor. Figure out fixed costs then set variables costs according to different levels of production. Divide the cost by the units manufactured and the result is your incremental or marginal cost.

- Although Pebble is sure of making it big, they need to calculate the incremental revenue once launched.

- The incremental cost was kept lower at $70,000 while producing twice its production capacity, leading to a higher net income.

- Whether you’re optimizing business processes, designing public policies, or improving patient care, understanding incremental costs empowers you to navigate complex choices effectively.

- Hospitals and clinics often face decisions related to medical services.

- One of the most effective ways to do this is by injecting new capital into the business.

Incremental Cost: How to Calculate and Use It for Decision Making and Cost Benefit Analysis

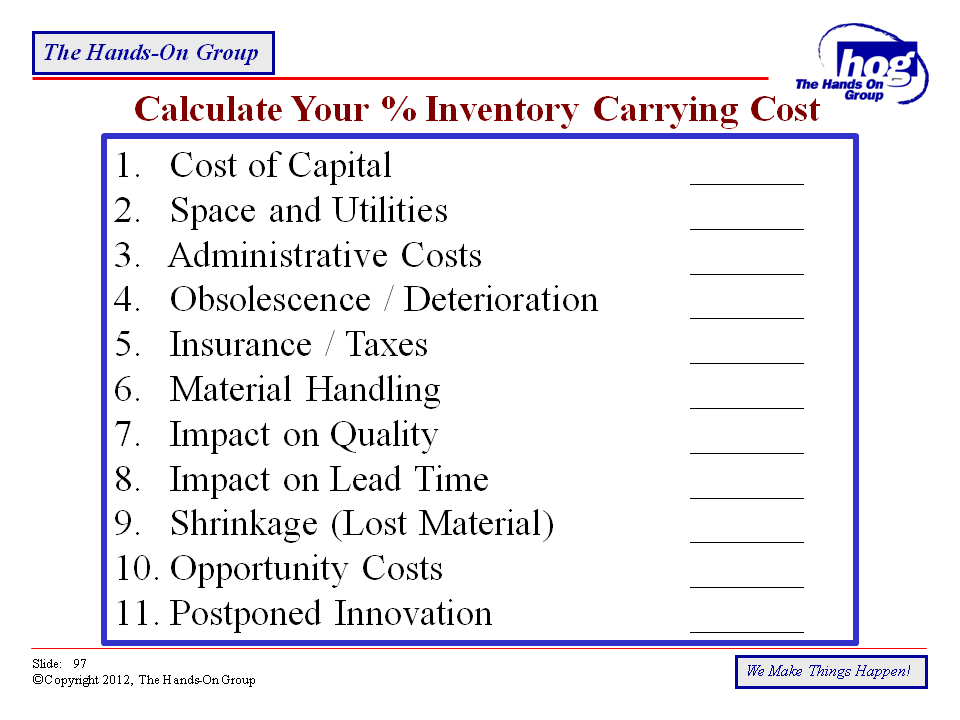

The WACC calculation is frequently used to determine the cost of capital, where it weights the cost of debt and equity according to the company’s capital structure. A high composite cost of capital indicates that a company has high borrowing costs; a low composite cost of capital signifies low borrowing costs. Software companies often face decisions about incremental cost developing new features or enhancing existing ones.

How to Make a Spending Decision With Marginal Analysis

When it comes to decision making and cost-benefit analysis, understanding the concept of incremental cost is crucial. Incremental cost refers to the change in total cost that occurs as a result of producing or consuming one additional unit of a good or service. It helps businesses and individuals make informed choices by considering the additional costs incurred and the potential benefits gained. Incremental cost, also known as marginal cost, is a key concept in petty cash managerial accounting and financial analysis. It refers to the additional cost incurred when producing extra units of a product or service. Understanding how to accurately calculate incremental costs is important for making sound business decisions.

- The fixed costs dont usually change when incremental costs are added, meaning the cost of the equipment doesnt fluctuate with production volumes.

- In summary, incremental cost empowers us to make informed choices, optimize resource allocation, and navigate complex decision landscapes.

- Discover the key financial, operational, and strategic traits that make a company an ideal Leveraged Buyout (LBO) candidate in this comprehensive guide.

- Remember, the devil is in the details, and incremental analysis helps uncover those crucial details that drive smart decisions.

- Fixed costs do not change when additional units are produced, so they should be excluded.

Importance of Incremental Cost in Decision Making

- Companies may then react by tapping the capital markets for equity funding.

- Since incremental costs are the costs of manufacturing one more unit, the costs would not be incurred if production didn’t increase.

- Companies often use a combination of debt and equity issuance to finance their operations.

- These questions require careful consideration, and one powerful tool that can guide decision-making is incremental analysis.

- But the incremental benefit—customer retention and word-of-mouth marketing—far outweighs this cost.

- This is because fixed costs are not relevant to the decision of whether or not to pursue a new project or venture.

The calculation is used to display change in cost as production rises. If you manufacture an additional five units, the incremental cost calculations shows the change. The calculation is critical for financial planning, accounting and understanding your costs, margins and profitability at different levels of production. Incremental cost includes a cost-to-benefit analysis to guide businesses in smartly choosing battles. If you increase your output to 15,000 shirts at a total cost of $120,000, your incremental cost will be $20,000. This means the $20,000 additional cost will produce 5,000 extra units on your product line.

Keep a spreadsheet with incremental costs noted against different levels of production. You can use this as a tool to manage cash flow while ensuring you are prepared for cost increases. Scaling production is a great goal but you must be sure the market is prepared to purchase and absorb your productions at the increased level. As your production rises, the cost per unit is lowered and your overall profitability increases. You can setup a spreadsheet with the formula to automatically calculate incremental costs at any level of production. This is makes https://www.bookstime.com/ production-based, decision-making processes more efficient.