(e) Non-financial information regarding quality flexibility and value to the customer can be received. For example, PCB Ltd. is manufacturing circuit board for computer monitor, TV and aeroplane. However, the circuit board for the aeroplane is tested for a longer time by highly paid technicians because it must be 100% error-free.

- Activity Based Management (ABM) differs from Activity Based Costing (ABC).

- The cost pools are then analyzed and assigned a predetermined overhead rate that will eventually be assigned to individual jobs and products.

- These traditional costing systems are often unable to determine accurately the actual costs of production and of the costs of related services.

- Generally, the scope of an ABC project should be kept fairly narrow, to make the project easier to manage and more cost-effective.

- The approach has proven useful in many service industry areas including healthcare, construction, financial services, governments, and other industries.

The main focus is on activities performed on a particular product during its production. As a result, traditional systems tend to over-cost high volume products, services and customers and under-cost low volume. Most small business accounting software applications do not offer the capability to automatically calculate product costs using the ABC method of costing. However, they are equipped to provide you with the financial information necessary in order to use this costing method for your business. Service businesses can also use activity-based costing to determine whether the services offered are accurately priced.

Steps to Follow in Activity-Based Costing

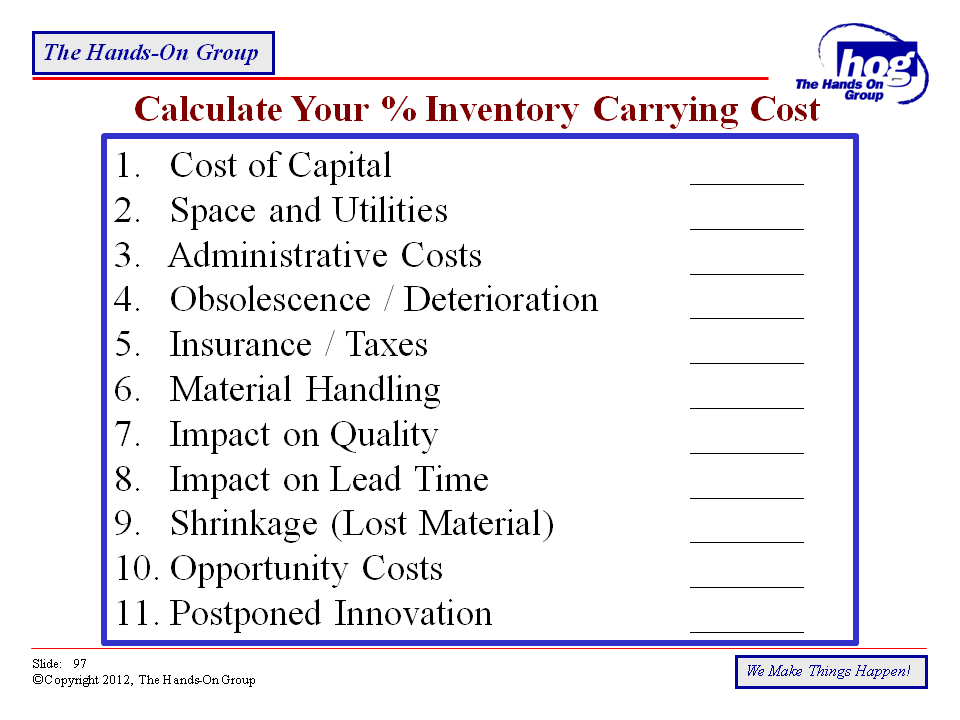

You might not attribute your business’s everyday activities to consistent small costs. You might not think just how much money goes into each particular product you offer, besides raw materials and labour. There are many indirect costs that you incur with everything your business offers. It improves the traceability of the overhead costs which results in more accurate unit cost data for management. It increases the number of cost pools used to accumulate overhead costs. Thus, instead of accumulating overhead costs-in a single company- wise pool or departmental pools, the costs are accumulated by activities.

When considering all relevant activities, overhead costs in manufacturing each product are actually less than that estimated by labor hours only. An activity is an event, task, or unit of work with a specific purpose, whether it be designing Donations for Nonprofits and Institutions products, setting up machines, operating machines, or distributing products. Therefore, activity-based costing considers all the potential activities instead of relying on just one variable (for example, labor hours or machine hours).

Activity-Based Costing Systems Are Expensive

As you can imagine, using just one cost driver can lead to inaccurate cost measurements. It improves product costing procedure as compared to traditional costing because it recognizes that many so called fixed overhead costs change in proportion to changes other than the production units. It means, under ABC, the other two activities-batch level and product level are assumed to influence fixed overhead costs and batch and product level, thus are accepted as non-unit based cost drivers. Activity based costing (ABC) is an accounting methodology that assigns costs to activities rather than products or services. As the tables above illustrate, with activity based costing the cost per unit decreases from $0.46 to $0.37 because the cost of the setup activity is spread over 50,000 units instead of 5,000 units. Without ABC, the cost per unit is $0.40 regardless of the number of units in each batch.

If we apply the ABC process we can see that Step 1 is complete as we know what the cost pools are. When a company asks its employees to report on the time spent on various activities, they have a strong tendency to make sure that the reported amounts equal 100% of their time. However, there is a large amount of slack time in anyone’s work day that may involve breaks, administrative meetings, playing games on the Internet, and so forth.

How confident are you in your long term financial plan?

Based on this information,

management could think about better ways to use Justin’s time. By

improving their signs and posting information about the movies,

management could reassign Justin to other tasks. Closely related to activity-based

costing is the notion of activity-based management (ABM). Using

activity-based management, managers identify which activities

consume resources.

- The Activity Based Management (ABM) system provides information and data on activity performance.

- Hence the reported application for production tasks do not appear as a favorized scenario.

- Activity-based costing (ABC) enhances the costing process in three ways.

- Below, we’ll cover the steps you need to take to implement a cost accounting ABC system.

This means you can finally say goodbye to broad, inaccurate cost allocations and hello to a more detailed and precise picture of your business’s expenses. https://www.wave-accounting.net/fund-accounting-101-basics-unique-approach-for/ System has developed basically on account of the limitations of the traditional absorption costing system. Thus, the activity based system system uses activities instead of functional departments (Cost Centers) for absorbing overheads. These are just a few of the things that activity-based costing will clearly point out to you, allowing you to make the management decisions that can streamline operations and save money. By assigning a cost to every activity involved in producing each product, you will be able to avoid under-pricing or over-pricing your products. For example, we are pretty accurate in measuring the cost of denim,

which is a direct material, in each of our shirts, pants, jackets,

and so forth.

Which of these is most important for your financial advisor to have?

The next step is to assign costs to each resource in each cost pool. For example, you can use dollars for purchases or hours for each machine used to produce the product. Go through each item in each pool and assign a unit that can be easily measured. Do you wish you knew how to implement an ABC system so that you can cut production costs, decrease waste and increase profits? You should read our guide, which will open your eyes to the world of activity-based costing.

Diverse, flexible manufacturing demands a more accurate approach to costing. However, much modern manufacturing relies on highly automated, expensive manufacturing plants – so much so that some companies do not separately identify the cost of labour because there is so little used. Instead, factory labour is simply regarded as a fixed overhead and added in to the fixed costs of running the factory, its machinery, and the sophisticated information technology system which coordinates production.